In the June/July 2024 edition of the Construction Magazine, CPAS Business development Manager Susan O’Mara reports on why construction employers need to act now on pensions.

Employers need to be aware of the latest developments and obligations related to pensions in Ireland. One of the most significant changes for construction employers in this area is Auto Enrolment, which is now in its final stages. The Government’s Auto Enrolment scheme has been planned for a long time and is finally in draft legislation stage in the Dáil.

The scheme is set to start on 1 January 2025, which is later than the original target of mid-2023.

The scheme, which aims to ensure that everyone working in Ireland is saving for retirement, will be co-funded by employers and the state. Contributions to the scheme will start at a low rate and will gradually increase over the next 10 years. Employers will need to make sure that their staff are covered by their existing pension arrangements, or they will automatically be enrolled into the Government’s scheme.

Through the Sectoral Employment Orders (SEO) and previous REA, the construction sector has been ahead of the game on pensions for almost 60 years, for certain workers anyway. Employers will need to consider the advantages and disadvantages of introducing Auto Enrolment in their business or adjusting and using their current occupational pension schemes.

One key factor to think about is the tax relief system. The current system, which makes pensions very appealing, will be different in the Government scheme.

Currently, pension members get tax relief on their contributions, at the rate they pay tax, so if paying tax at 40%, the cost of a €100 pension contribution would be €60.

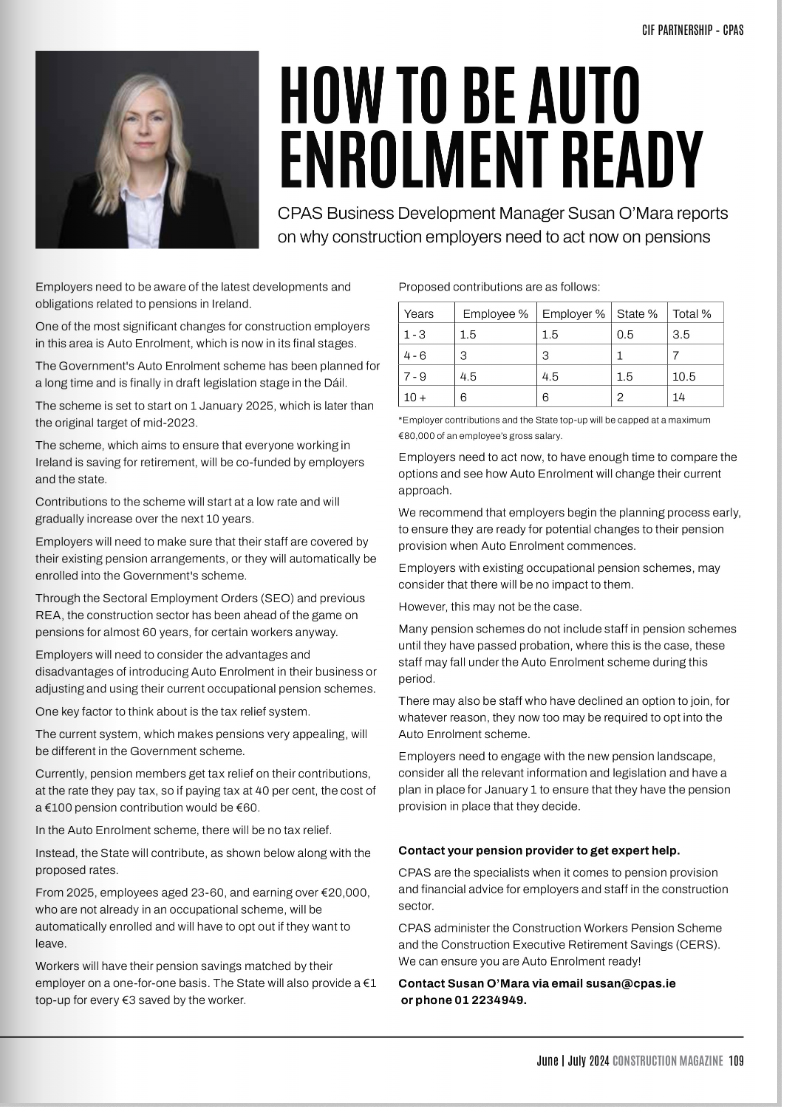

In the Auto Enrolment scheme, there will be no tax relief. Instead, the State will contribute, as shown below along with the proposed rates.

From 2025, employees aged 23-60, and earning over €20,000, who are not already in an occupational scheme, will be automatically enrolled and will have to opt out if they want to leave. Workers will have their pension savings matched by their employer on a one-for-one basis. The State will also provide a €1 top-up for every €3 saved by the worker.

Proposed contributions are as follows:

| Years | Employee % | Employer % | State % | Total % |

|---|---|---|---|---|

| 1 – 3 | 1.5 | 1.5 | 0.5 | 3.5 |

| 4 – 6 | 3 | 3 | 1 | 7 |

| 7 – 9 | 4.5 | 4.5 | 1.5 | 10.5 |

| 10 + | 6 | 6 | 2 | 14 |

*Employer contributions and the State top-up will be capped at a maximum €80,000 of an employee’s gross salary.

Employers need to act now, to have enough time to compare the options and see how Auto Enrolment will change their current approach. We recommend that employers begin the planning process early, to ensure they are ready for potential changes to their pension provision when Auto Enrolment commences.

Employers with existing occupational pension schemes, may consider that there will be no impact to them.

However, this may not be the case. Many pension schemes do not include staff in pension schemes until they have passed probation, where this is the case, these staff may fall under the Auto Enrolment scheme during this period.

There may also be staff who have declined an option to join, for whatever reason, they now too may be required to opt into the Auto Enrolment scheme. Employers need to engage with the new pension landscape,

consider all the relevant information and legislation and have a plan in place for January 1 to ensure that they have the pension provision in place that they decide.

Contact your pension provider to get expert help.

CPAS are the specialists when it comes to pension provision and financial advice for employers and staff in the construction sector.

CPAS administer the Construction Workers Pension Scheme and the Construction Executive Retirement Savings (CERS).

We can ensure you are Auto Enrolment ready!

Contact Susan O’Mara via email susan@cpas.ie or phone 01 2234949.